Machine Learning

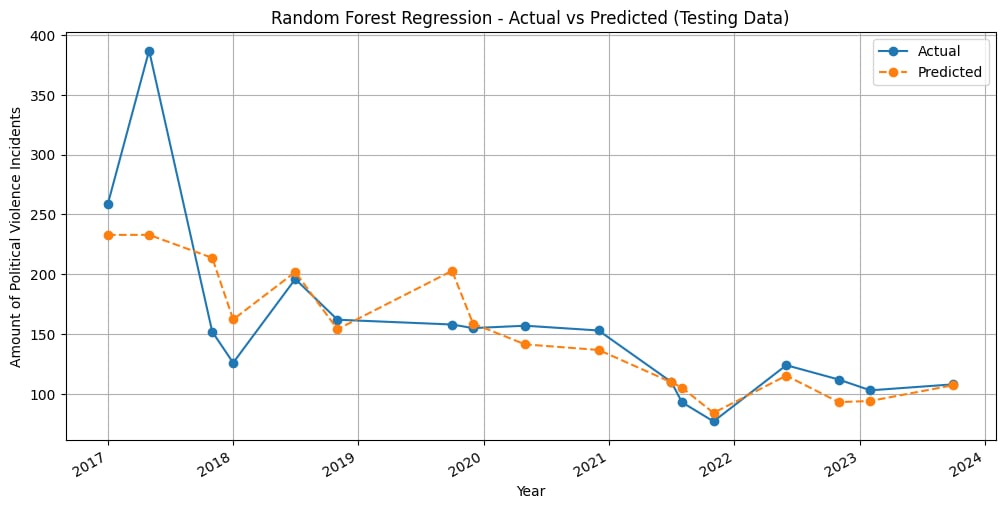

Machine learning played a pivotal role in our study, where we trained a supervised model to forecast the number of political

violence incidents based on economic indicators such as CPI, GDP, and Real Effective Exchange Rate. We explored various regression

models including Random Forest, Gradient Boosting, Neural Network, Ridge, Linear, and Support Vector. Utilizing GridSearchCV, we

fine-tuned these models' hyperparameters to enhance their performance.

Among these, the Random Forest Regression model delivered the most promising results, boasting a Mean Squared Error (MSE) of 1760.41

and an R-squared of 0.70. MSE quantifies the average squared difference between predicted and actual values, providing a clear measure

of prediction accuracy. Meanwhile, R-squared indicates how well the model fits the data, with higher values signifying a better fit.

The optimal parameters identified for the Random Forest model were: 'bootstrap': False, 'max_depth': 10, 'max_features': 'sqrt',

'min_samples_leaf': 1, 'min_samples_split': 5, 'n_estimators': 50. Furthermore, it revealed that the most important features include

CPI Price, Stock Markets, GDP at market prices, and Real Effective Exchange Rate.

A Random Forest Regressor functions by constructing multiple decision trees, each trained on different subsets of the data and features.

These trees collectively predict outcomes, and the final prediction is an average of their individual forecasts. This ensemble method

mitigates overfitting and enhances robustness by leveraging the diverse insights from multiple trees, thereby offering more accurate

and reliable predictions than individual decision trees alone.

To evaluate our model's effectiveness, we divided the dataset into training (80%) and test (20%) sets. With the trained Random Forest model,

we successfully predicted the incidence of political violence incidents based on economic factors. The accompanying plot illustrates the model's

performance against the test set, demonstrating its predictive capability.

Limitations

A more robust hyperparameter tuning is recommended in the hope of achieving better models. Moreover, the researchers believe that better models

will surely arise from larger datasets of higher quality.